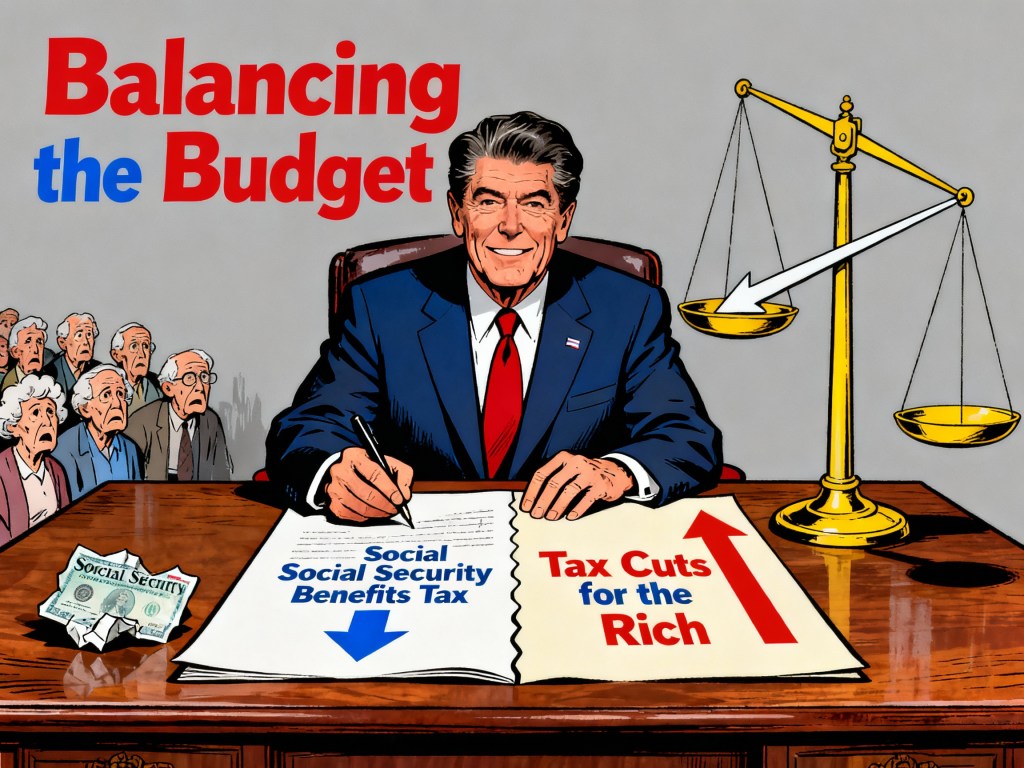

How the 1983 Social Security Reforms Financed Reagan’s Tax Cuts for the Wealthy

The 1983 Social Security Amendments were enacted primarily to finance Ronald Reagan’s sweeping tax cuts for the wealthy. After the Economic Recovery Tax Act of 1981 slashed the top marginal income tax rate from 70% to 50% and provided significant breaks for corporations and high-income earners, the federal deficit surged dramatically[1][2]. To offset the resulting revenue shortfall, Reagan and Congress passed the 1983 Social Security Amendments, which included a provision to tax up to 50% of Social Security benefits for higher-income retirees[3][4].

Detailed Mechanism

- The new tax on Social Security benefits applied only to individuals and couples with income above $25,000 and $32,000, respectively, meaning it primarily affected middle- and upper-income retirees rather than low-income beneficiaries[3][5].

- The revenue collected from this tax was credited directly back to the Social Security trust funds, helping to close the funding gap caused by Reagan’s earlier tax cuts for the wealthy[3][5].

- The law also included other provisions, such as accelerating scheduled increases in payroll taxes and gradually raising the normal retirement age to 67, but the decision to tax benefits was directly tied to the need to finance Reagan’s tax reductions for the rich[5][4].

Motivation and Broader Context

- The 1983 reforms were framed as a bipartisan effort to save Social Security from insolvency, but they were fundamentally designed to offset the fiscal impact of Reagan’s tax cuts, which primarily benefited high-income earners and corporations[3][4][2].

- The tax on Social Security benefits was a direct mechanism to raise revenue to help pay for tax cuts that favored the wealthy, while protecting the solvency of the Social Security system for decades to come[3][4][2].

- Treasury estimates later showed that the 1981 tax cuts reduced federal revenues by about 9% in the first couple of years, and the 1983 reforms were part of a series of tax increases to address the resulting deficits[4].

Resources

- Social Security Amendments of 1983 (SSA)[5]

- What we learned from Reagan’s tax cuts (Brookings Institution)[4]

[1] Reagan tax cuts – Wikipedia

[2] How four decades of tax cuts fueled inequality – Public Integrity

[3] Social Security History – SSA

[4] What we learned from Reagan’s tax cuts – Brookings Institution

[5] In-Depth Research – SSA

Leave a comment